Get to know the details of the Carbon Pricing Rebates Date 2024: When CAIP and Carbon Pricing Rebates Are Coming from here. The citizens who have applied for the rebate would be willing to note the Carbon Pricing Rebates Date. They have to pay for the utility bills and similar. They can get the complete information further from this article.

Carbon Pricing Rebates Date 2024

Up to $500 is provided to Canadians as a crucial part of the carbon pricing rebate. The Government has started this program as an incentive for the people who need to pay the Carbon Tax. $65 per tonne was the tax rate for individuals in the year 2023 but the rumours are delivering the message that by 2023, the Carbon tax will reach to %170.

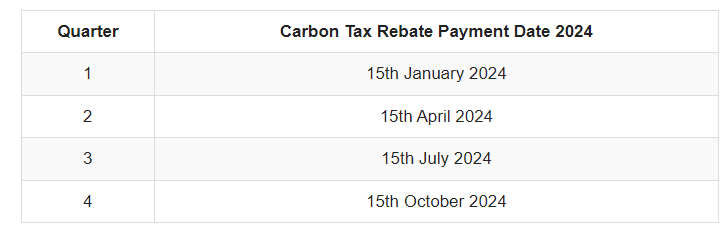

January, April, July, and October are the staggered dates at which the payment is provided to eligible citizens. The Canada Revenue Agency transfers the amount to the beneficiary’s account. The authorities use the direct deposit method for competing the amount transfer process.

|

Important Links |

What are Social Welfare Programs in Canada?

Income Support, Employment Insurance, Canada Child Tax Benefit, Public Pensions, Disability Credits, and more are launched in the country for the welfare of the citizens. Usually, the citizens who are earning a low income or cannot afford a living are eligible for these.

There is an application procedure that has to be followed by the citizens to get the benefits. The CRA considers the details and the documents that are uploaded along with the form.

What is Climate Action Incentive Payment?

The temperature in the country is generally low, meaning that there is a need for heating appliances to keep pace for the countrymen. CAIP is provided as a credit to low-income households to manage their living at extreme temperatures.

| Beneficiary Type | Ontario | Alberta | Nova Scotia |

| People who are a Single Parent | $244 | $386 | $248 |

| Single Individuals | $122 | $193 | $124 |

| CAIP for Children | $30.50 | $48.25 | $31 |

| Couples | $61 | $96.50 | $62 |

As seen in the table above, the citizens will receive the incentives accordingly. We have shared the details of only a few provinces here, the list can be checked from a relevant portal.

Who is Eligible for Carbon Pricing Rebates?

The credits will only be transferred to the beneficiary’s account if the eligibility criteria are met. Check if you can get it or not from below:

- The citizens have to be older than 19 years.

- You must be staying with your law partner.

- The immigrants have to submit an application to get the rebate.

- Permanent residency or proof of an immigrant has to be submitted.

It is recommended to the residents that they must plan the utilisation of the rebates. There are options to save some money by travelling for a lesser duration from the vehicle. Take local transport if possible. In case of fuel for cooking, switch to an alternate method if possible.

When CAIP and Carbon Pricing Rebates Are Coming?

The taxation agency has a certain procedure that is followed to provide a considerable amount to the citizens. The process revolves around the “My CRA Account”. The website is secure to access and can be easily navigated by users who do not have much technical knowledge.

|

Important Links |

Create the My CRA Account, or in case you are an old user, login into the portal. The application procedure is different according to the provinces. The authorities have started to transfer the considerable amount form the mid of January 2024. The image below represents the payment dates.

As we have mentioned, kindly visit the official website to get the updates. There might be a condition when the payment is not transferred. In that case, contact the CRA to reapply for the rebate.

Carbon Pricing Rebates Benefits

The cost of living in higher in Canada is 880 CAD for single individuals, CAD 18340 for couples and more than CAD 10000 for students. In this case, the low-income earning individuals receive the credits for paying the carbon tax as the fuel is needed for household purposes as well as in the vehicles. This directly comes into daily living.

The amazing thing to know here is that the rebate is not taxed which means that you will have the whole amount with you that could be a contribution for the monthly savings. The citizens who are unable to utilize the heating appliances can now buy them and make their efficient use. The provision will be followed in discrete provinces of the country.