Get to know the factual details of the 2024 Canadian Tax Updates: Important Changes Everyone Should Know About in Canada. The citizens have to follow the 2024 Canadian Tax Updates while paying the taxes for the present fiscal year. They can get the assistance from their accountant to complete the tax return procedure.

2024 Canadian Tax Updates

CPP/OAS Increase, higher inflation, and cost of living have affected the Canadian Tax Updates for 2024. The Government has thought of increasing the tax rates as well to cope with the financial challenges.

The Federal Government will be providing the dates as well as the rates at which the tax changes. The citizens will be charged with 15% tax for the present financial year. Continue reading the article to know the details.

|

Important Links |

Functions of the Canada Revenue Agency

Unlike the IRS in the UK and the USA, CRA is the responsible authority for managing taxation. CRA administers tax benefits and suitable changes for the citizens. The economy of the country withstands due to the regulations made by the officials. The well-being of the citizens is vital, thus, effective decisions are made.

CRA is focused on maintaining integrity, security, compliance, and peaceful strategies for the welfare of the citizens. The people have to follow the law and for any queries, they can simply connect with the officials during working hours.

Canada Tax Brackets 2024

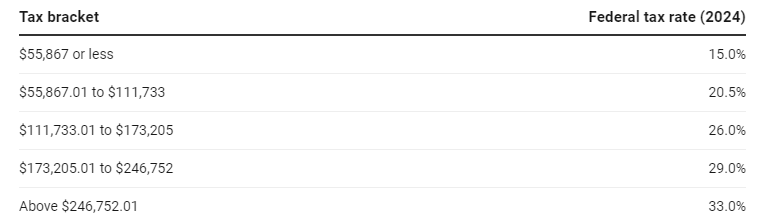

Let us make you understand first for the tax brackets. These are basically the marginal rates at which the moderate to high-income earning individuals have to pay the taxes. Consumer Price Index is the critical factor that is considered for creating the Canada Tax Brackets 2024.

The tax rates from these brackets are according to the credits, benefits, allowances, income, or more for a particular individual or a business. The tax rates which are imposed by the Federal Government have to be followed by each province and the territory.

The tax brackets have been revised from the previous year. However, as we have discussed above, the changes in the rates are as per the inflation and CPI. The Canadian Government would like to assure the citizens with the several benefits and therefore, the ease is provided to them in terms of the tax credits.

Child tax credit, universal credit, income support, allowances, pensions, and more are subjected to the eligible beneficiaries. In discrete cases, the citizens have to provide an application for countouring the benefits rest CRA considers the tax returns to provide the financial support.

|

Important Links |

The effect will be observed on the low-income households and the seniors. They have to handle the family with a limited amount of money. They would be planning to apply for part-time work so that they can contribute some more bucks for a particular month.

Important Changes Everyone Should Know About in Canada

Modifications in the tax rates are important to be ahead in terms of the Gross Domestic Product. Below are the changes that have been provided by the Government.

- Carbon Tax: $80 per tonne will be implemented for the year 2024. Thus, the gas prices will be 17.6 cents

- Home Office Expenses: Form T2200 has to be filled by the employer to claim the benefits or to know the tax rates.

- Employment Insurance: EI has been increased to 1.66 percent. For Quebec residents, 1.32 percent will be the increase.

- Digital Services Tax: According to the 3% increase in the digital services taxes, the vendors will be experiencing a tax burden of 40% and 5 percent by the companies.

- Federal Income Based Tax: The tax measures report was shared in December 2023 including the changes for the year 2024.

- Alcohol Tax: 4.7 percent will be on wine, beer, and spirits.

These significant changes are also available on the site of the Canada Revenue Agency. These changes have affected the way in which individuals meet the expenses in their daily lives. They have to wonder twice about spending their hard-earned money. The Government provides credit to the people to manage their finances. Still, they have to find other ways of earning a passive income.