Check the details about the NZ Council Rates 2024: Auckland, Waikato, Hamilton, Tauranga, and Other Council Rates Check here. The local property taxes and several other services are managed by the council rates. The complete details about the NZ Council Rates have been discussed in this article.

NZ Council Rates 2024

The rates are paid on the property owned in the country half the interest will be distributed to the new roads and the municipal corporate works. The council rates are the general operative amount issued for owning the houses or the rental space in the country. The mortgage is the largest cost of expenses but not the operational amount. The local property tax amount collects a huge amount from the investment in real estate and these amounts are used for property maintenance and local infrastructure.

The rating evaluations are processed each year, and according to the management of the real estate, the rates are decided by the council. The rates for the council have been constantly increasing in the upcoming years. In the Annual Budget of 2023 and 2024, the value has been increased by 7.7 percent. The council sets the rate to collect nearly $679.8 million. The council has to fund around $447 to provide the operational work that the city needs. As a part of these, $227.8 million is the amount collected from the local 57,809 residents and 3,800 commercial customers. The process has been discrete in each region of the country. The local authorities maintain the operational coat depending upon the facilities required in the specified region.

|

Important Links |

Auckland Council Rates 2024

The Rating Information Database records all the council and property rates of Auckland. The rating unit includes the district valuation roll. The information available in RID instead of DVR such as the reliability information and the location of the property. The evaluation of the property is set every year. The operational rates are set according to the progression of the locals. The annual assets and the council rate for the region are set to be increased by 7.7 percent. The overall changes will be noticed in the management of the local authorities.

A residential property with the minimum capital value will notice an increase of $253 per year. The total rates include the total capital value the rates invested in the waste collection and the target value of the property such as the water supply and the maintenance for the climatic change initiative. The average increase in the general rate will be 11 percent which includes the services issue in the locality.

- Reduction of the water quality target rate by $57.89

- Reduction of the climatic change target rate by $32.7

- Increase in the waste management base services by $45.6.

The business property with the average capital interest will mark the increament of 8.2 percent

Waikato Council Rates 2024

The revaluation for the property rates was implemented in November 2023 and the council rates are being discussed for the new fiscal year. The new rates are to be implemented from July 2024. The maximum payment rate for the operative council is $740.

The general rate for the capital value is $229.75 for every 10,000 increase. The uniform annual charge, community facility value, and capital contribution target are not included in this general council.

Hamilton Council Rates 2024

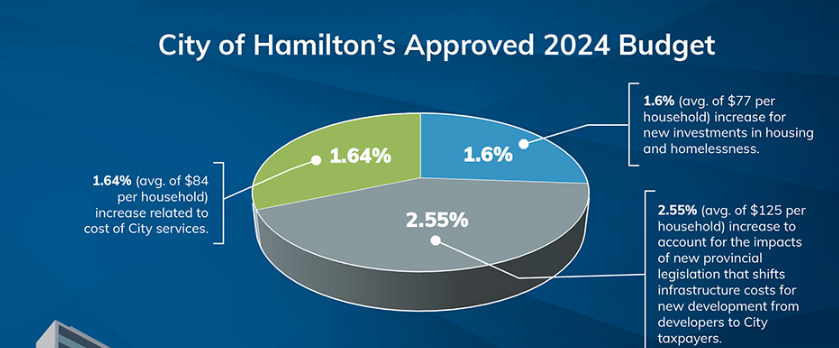

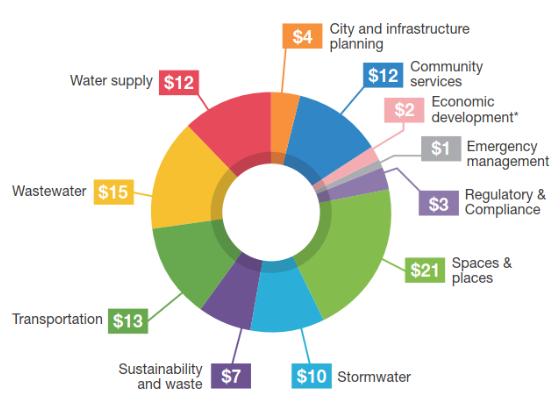

The general budget for the council rate for the residential property has been increased by 5.6 percent. The changes are made to provide a committed quality program and services across the city. The infrastructure and the maintenance of the water supply, sewage, and pollution are part of the general rates.

The budget has been planned to maintain the service in the city. The above image shows the increament in the services and cost of services that impacted the minimal changes.

|

Important Links |

Tauranga Council Rates 2024

The city council is the debted council of the country with charges of $1.1 billion expected by 2025. Many projects are to be initiated in the upcoming month. The budget has been allocated to the capital value of these upcoming projects. The council professed the debt level for the next year with $1.5 billion. The council rates include the transport facility and the water service across the city.

The council’s total income includes operational income of $334 million and asset development income of $165 million. The other rates included the council rate is 12 percent of the user fees, 17 percent of the government subsidies, and the grants issued.

Other Council Rates Check

Other than the city council rate the general contribution that is made for the welfare of the country includes the income of the general asset and the multiple property values owned in the country. The general rates are charged for how expensive the house is and the services that are issued in the city. Many other cities have their local authorities to maintain the council rates.