Check out different details about Form 1120: What is a 1120 Tax Form and How to File it? from this article. Various information regarding Form 1120: What is a 1120 Tax Form and How to File it? and other relevant details are included in this article.

Form 1120

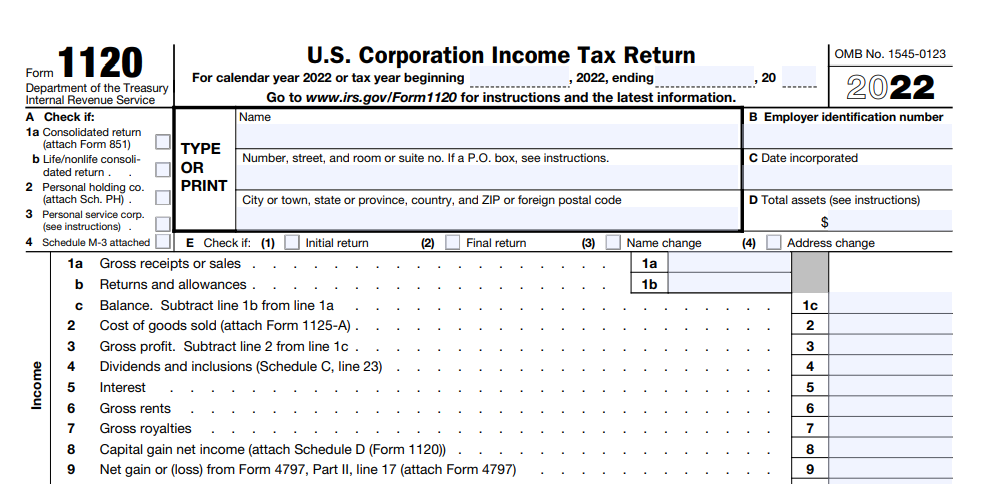

Form 1120 is the IRS form utilised by companies to report their income, losses, gains, and deductions and calculate their income tax liability.

All domestic corporations are required to file this tax return even if they are in bankruptcy. However, the domestic corporations that are exempt under Section 501 are not required to file this tax return.

|

Important Links |

What is a 1120 Tax Form?

Form 1120 is also known as U.S. Corporation Income Tax Return. Each year, this form is revised by the IRS according to the tax year. Depending on the purpose, the corporations can file various schedules associated with this form.

For example, Form 1120-F can be used for the Income Tax Return of a Foreign Corporation, Form 1120-H can be used for the Income Tax Return for Homeowners Associations, Form 1120-L can be used for a Life Insurance Company Income Tax Return, etc.

Each variant of this form comes with its own set of instructions that can provide significant information about the purpose, deadline, and how to fill it.

How to Download Form 1120?

Corporations who need to file their income tax return can download this tax form by visiting the authorized website of the IRS.

To download this form –

- Visit the website of the IRS.

- Click “Forms and Instructions”.

- Search for Form 1120 and download it.

S corporations can use the 1120-S to file their income tax returns. This can also be downloaded in the same manner as the Form 1120.

Who should file it?

Unless exempted, all corporations should file an income tax return. In case a domestic corporation opts to file a special return, they don’t need to file this form.

A domestic entity that opts to be taxed as a corporation should file this form. These entities are also required to file Form 8832 and attach its copy with the Form 1120. Corporations engaged in farming should also file this form to report their income.

When to file it?

Corporations have to file their income tax return by the 4th month’s 15th day after the end of the tax year. The same time limit also applies to new corporations who file short-period returns. They must file by the 4th month’s 15th day after the end of their short period.

If a corporation’s fiscal year ends on June 30, they should file their income tax return by the 3rd month’s 15th day after their tax year ends. The IRS also offers Private Delivery Services that can tell corporations how to get mailing date’s written proof.

If a corporation cannot file their income tax return by the deadline, they can apply for an automatic extension. Many corporations use this form so that they can get more time. People can find all the information about extensions from the IRS’s website.

For extension purposes, the corporations can use Form 7004. Please note that the corporations cannot file their form after the deadline passes. They must file it before the set deadline in order to get approval for an extension.

How to File it?

To file Form 1120, corporations must download it and fill it in with the correct information. This can be used to report income, deductions, losses, etc. Please note that the return must also be signed and dated by the CAO, president, treasurer, vice president, assistant treasurer or any other authorized person.

This tax form can be filed using a paper return method or electronically. Moreover, corporations must attach all the applicable schedules in the correct order so that the processing can be done more efficiently and faster.

Initially, people have to fill in the name, address, EIN, incorporation date, and total assets on this form. The first page of this significant form consists of three main sections – income, deductions and tax, payments, and refundable credits.

|

Important Links |

The second page contains Schedule C, the third page contains Schedule J, the fourth and fifth pages contain Schedule K, sixth page contains Schedule L, M-1, and M-2.

Each section has a different purpose that the corporations have to fill in correctly, if applicable. However, they should first read the instructions before proceeding to fill out this form, as they can provide them with various crucial information.