Check out the details about Golden State Stimulus Checks 2024 Tracker, the Latest Update, and Payment Dates from this article. Different information regarding Golden State Stimulus Checks 2024 Tracker, Latest Update, Payment Dates, and other significant details are included in this article.

Golden State Stimulus Checks 2024

The Government of California introduced the Golden State Stimulus with the aim of supporting low and middle-income citizens and helping those facing hardship due to the pandemic. The stimulus is for the citizens that have filed their 2020 tax returns. Furthermore, there are two types of Golden State Stimulus – GSS I and GSS II.

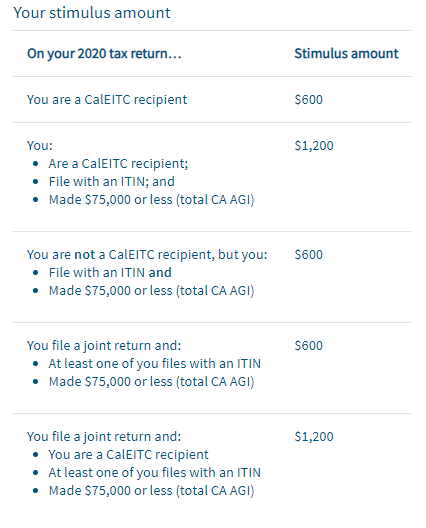

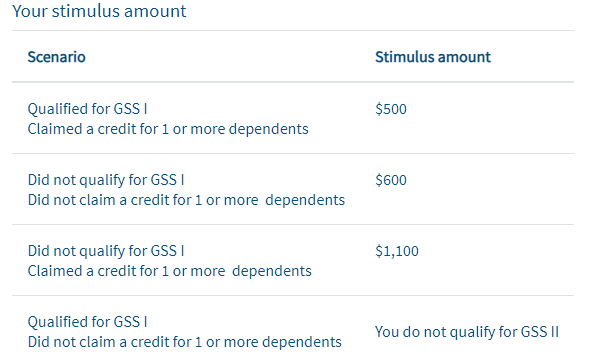

The GSS I or Golden State Stimulus I Payment amount can either be 600 dollars or 1200 dollars (according to the eligibility). Whereas the GSS II or Golden State Stimulus II can either be 500 dollars, 600 dollars or 1100 dollars (according to the eligibility).

|

Important Links |

Golden State Stimulus Overview

| Name | Golden State Stimulus |

| Administering Body | Franchise Tax Board, CA |

| State | California |

| Country | United States |

| Types | GSS I and GSS II |

| Stimulus Amount (GSS I) | 600 dollars/1200 dollars |

| Stimulus Amount (GSS II) | 500 dollars/600 dollars/1100 dollars |

| Website | ftb.ca.gov |

Golden State Stimulus Checks Tracker 2024

The Golden State Stimulus Checks can be tracked using the authorized website of the Franchise Tax Board. The tracker will allow the residents to check the amount of stimulus payments with dates. Previously, the Golden State Stimulus helped many individuals and families residing in California.

Citizens who have filed their required taxes on time can expect their Golden State Stimulus Checks very soon. Aside from California, various other states in the US have also initiated stimulus checks for their respective residents. For further information on the Golden State Stimulus Checks, the citizens can check the authorized website of the FTB California.

Golden State Stimulus Eligibility 2024

The FTB California provides all the eligibility guidelines for the Golden State Stimulus 2024. As mentioned, there are 2 types of Golden State Stimulus Checks, with each one having different eligibility guidelines. Most individuals and families are eligible for GSS I, but GSS II has additional requirements to be satisfied. Check the Golden State Stimulus I amount –

Previously, individuals eligible for GSS I had to file their 2020 taxes, be California residents, and either CalEITC recipients or ITIN filers with income of $75000 or less. To be eligible for GSS II, individuals had to file their 2020 taxes by October 15, 2021, be California residents, and have wages ranging from $0 to $75,000 for the 2020 tax year and a CA AGI ranging from $1 to $75,000 for the 2020 tax year.

Check the Golden State Stimulus II Amount –

The new guidelines for the Golden State Stimulus (GSS I and GSS II) will be notified by the FTB California on its authorized website. It takes roughly about 3 weeks for the paper checks to be delivered once they are mailed out. Furthermore, the residents can also contact the helpline number or mail address provided by the FTB California.

Golden State Stimulus Checks Latest Update 2024

The latest updates regarding the Golden State Stimulus 2024 can be learned through the newsroom section. FTB California is likely to notify the new payment dates, amounts, requirements, procedures, etc., very soon.

|

Important Links |

Individuals can use a GSS II tool to check the estimated value of their stimulus checks. For this, they have to answer a couple of questions. After the completion of the questionnaire, the estimated stimulus of GSS II will be generated. In addition, if the individuals don’t qualify for the GSS II, they may still qualify for the GSS I. This is because the eligibility or qualification guidelines for both of them are different from each other.

Golden State Stimulus Checks Payment Dates 2024

The payment dates for 2024 will be provided by the Franchise Tax Board, California. The payment dates denote the exact date on which the authorities will deliver the required stimulus amounts. As mentioned, the amounts of Golden State Stimulus vary according to various scenarios. Once the checks have been mailed, they will take a couple of days to be delivered to the intended recipient.

According to the information, the payment or checks will be delivered on the basis of the last 3 digits of the area pin codes. For example, previously, the GSS checks were sent from October 6, 2021, to October 27, 2021, for the 000-044 pin code. The complete payment dates are based on the last 3 digits of her area pin codes available on the authorized web portal of FTB California.

| IT Gujarat Home Page | Click Here |

Hello.I’m Canadian and I have 5 kids.I want to buy our first house.Is it known if the government helps us in any way?I don’t know where to ask for information.Thank you.

I need that stimulus check we are both disabled and both are deaf

Why is it so hard to get the results of the stimulus package for SSI RECIPIENTS. PLEASE HELP ME WITH THE INFORMATION So I can get some help

Why is it so hard to get the results of the stimulus package for SSI RECIPIENTS. PLEASE HELP ME WITH THE INFORMATION So I can get some help

Evidently people who paid taxes and now retired Don t deserve to get a stimulus payment.And you have to live in New York or California or be illegal that never paid in a cent to get anything.