Check out the details about OAS Increase 2024: How Much will CPP and OAS Increase in 2024? Detailed Analysis from this article. Various details about OAS Increase 2024: How Much will CPP and OAS Increase in 2024? Detailed Analysis and other necessary information are contained in this article.

OAS Increase 2024

Old Age Security is one of the significant pension plans administered by the Canadian Government. OAS payments are usually issued each month to eligible people aged 65 and older.

However, people need to manually apply for the OAS in case the authorities don’t have enough information about them. The OAS Clawback limit is likely to increase in 2024 from 86,912 dollars to 90,997 dollars. More information about the OAS Increase in 2024 can be accessed through the official website of the CRA.

|

Important Links |

OAS Expected Increase 2024

| Name | Old Age Security |

| Country | Canada |

| Administered by | Government of Canada |

| Type | Pension Plan |

| Age Requirement | 65 or older |

| Current Maximum Payment | 707.68 dollars (age 65 to 74) | 778.45 (age 75 or older) |

| Payment Dates | November 28, 2023 | December 20, 2023 |

| For more information | canada.ca |

How Much will CPP and OAS Increase in 2024?

Recently, on November 1, 2023, the Canada Revenue Agency announced the new contribution rates and amounts for 2024. According to the CRA, the maximum pensionable earnings under CPP will increase to 68,500 dollars. This limit is currently set at 66,600 dollars (2023).

However, the basic exemption limit will remain the same, i.e., 3,500 dollars. As we know, a second earnings ceiling will be implemented. In addition, this will be used to determine the CPP 2 Contributions. The second earnings ceiling will be 73,200 dollars.

This additional implementation will result in the pensionable earnings from 68,500 dollars to 73,200 dollars being subject to CPP 2 contributions. The new ceiling was calculated on the basis of the CPP legislation.

CPP is a retirement pension plan that provides monthly payments to eligible Canadians. For this, a person should be at least 60 years old and must have made at least 1 CPP contribution. Unlike OAS, people need to apply to receive CPP benefits.

The pension amount of CPP is determined using the lifetime average earnings, starting age, and the CPP Contributions. Every person aged 18 and older working in Canada is required to make CPP Contributions. The contributions can help people to become eligible for Disability benefits, pension, post-retirement benefits, and survivor benefits.

However, the contributions stop when a person reaches 70 years of age, whether they are working or not. The contribution amount is determined on the basis of the income. The contributions to the CPP are made on the annual income between max and min amounts.

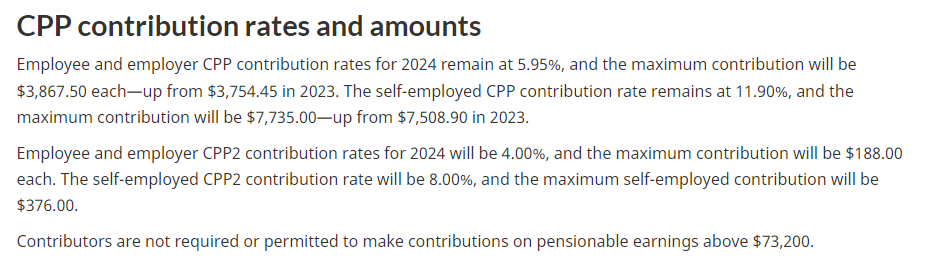

The contribution rate of the employer and the worker in 2024 will stay at 5.95%. However, the maximum contribution limit for each will increase to 3,867.50 dollars. The current (2023) contribution limit is set at 3,754.45 dollars.

Similarly, the contribution rate for self-employed people will remain at 11.90%. However, their maximum contribution limit will become 7,735 dollars. Previously (2023), this limit was set at 7,508.90 dollars. Please note that people cannot make contributions on their pensionable income exceeding 73,300 dollars.

The CPP 2 contribution of employers and workers will become 4%. Their maximum contribution limit will be 188 dollars (each). The CPP 2 Contribution for the self-employed people will become 8%, and their respective contribution limit will become 376 dollars.

Detailed Analysis of CPP and OAS Increase

The Contributions to the CPP are important because they play a major part in determining whether someone or their family members are eligible to receive the benefits. The benefit usually increases if someone earns and contributes more to the CPP before they start their retirement pension.

Starting in 2019, the CPP is being enhanced. The workers who are making valid contributions to the CPP will receive more benefits in future when they take retirements. However, the CPP enhancement only affects those who contribute to the CPP after 2019.

|

Important Links |

The current maximum payments and income thresholds for the OAS are (2023) –

| Age | Max Monthly Payment | Annual net world income (2022) |

| 65 – 74 | 707.68 dollars | less than 134,626 dollars |

| 75 and over | 778.45 dollars | less than 137,331 dollars |

The OAS is generally reviewed four times to reflect the increase in the cost of living. The monthly payment amount is not reduced even if the cost of living decreases.

Starting July 2022, people over 75 years or more automatically receive a 10% increase in the OAS. If someone has turned 75 after July 1, 2022, they will see an increase in the OAS in the following month of their birthday.

If someone’s income exceeds 86,912 dollars (2022), they have to repay either a portion or the entire OAS pension. According to the information, this limit will become 90,997 dollars in 2024.

It is always encouraging to see CPP, OAS and other government assistance increase somewhat with inflation. I do however have a bone to pick. Back two years during g the pandemic the government was overly dangerous to thoes that were forced to stay home to supposedly stem the pandemic. You know seniors had to endure this as well. What was done for their peice of mind? Nothing. We suffered just like everyone else yet were given no consideration. My point, the government could have stopped taxing our meger pension funds. That would have really helped. Inflation today is killing thoes of us on fixed incomes. How about a break for seniors?