Check out the details about Attendance Allowance Pitfalls: What are Attendance Allowance Pitfalls and How to Avoid Them? from this article. Various details about Attendance Allowance Pitfalls: What are Attendance Allowance Pitfalls and How to Avoid Them? and other significant details are included in this article.

Attendance Allowance Pitfalls

Each year, many applications for the Attendance Allowance are rejected by the authorities. The main reason behind it is the lack of information provided. This information can either be about their disability and its specific symptoms, or it can be other relevant information.

Most people don’t reapply for attendance allowance after the first rejection and can possibly miss out on the chance to receive the allowance when their circumstances change. Most of the pitfalls associated with the attendance allowance are linked to a lack of information.

|

Important Links |

Attendance Allowance Overview

| Name | Attendance Allowance |

| Country | UK |

| Lower Rate | £68.10 |

| Higher Rate | £101.75 |

| For more information | https://www.gov.uk |

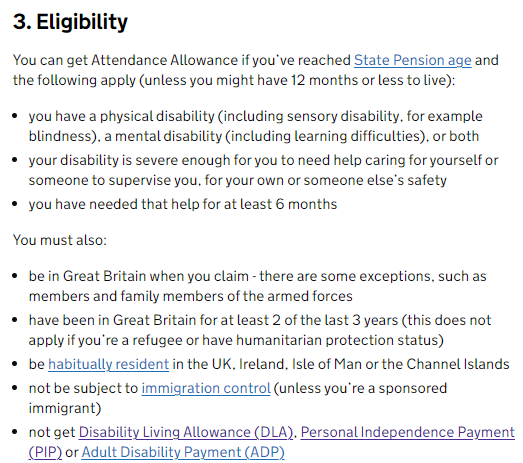

What is Attendance Allowance?

It is provided by the government when an individual has a severe disability they need someone to look after them. The attendant allowance can help them with their extra costs.

The UK Government pays the attendance allowance at 2 different rates. The first one is the lower rate and the second one is a higher rate. The higher rate is the maximum weekly amount that a person can receive. Whereas the lower rate is the minimum weekly rate that a person can receive.

For the current benefit year, i.e., 2023/2024, the allowance rates are – £68.10 (lower) and £101.75 (higher). In the previous benefit year, i.e., 2022/2023, the allowance rates were – £61.85 (lower) and £92.40 (higher).

This shows that the allowance rates can change over time depending on various factors. This can significantly increase the allowance that a beneficiary receives from the government (the increased rates can raise the total amount).

When the circumstances of a beneficiary are changed, they should immediately report it to the authorities. This is because certain changes in the living situation or circumstances can directly affect how much a person can receive from the Attendance Allowance.

If the changes are not reported and the government keeps on paying the allowance to the individuals, they will have to pay back the money and a penalty can also be charged. This is why people should keep reporting the changes on a regular basis to the authorities (if there are any changes to report).

What are Attendance Allowance Pitfalls and How to Avoid Them?

Some of the challenges that people face include a high application rejection percentage, an annual review, and a lengthy application process. Moreover, people not reporting circumstance changes can also create issues for them.

Not providing complete information:

- People should always provide accurate and complete information about their disability and situation.

- When a person doesn’t provide accurate and complete information, it can negatively impact the decision of their claim.

- When someone receives an assessment letter, it means that how the disability affects a person is unclear. In most cases, it can be due to the type of disability, but in some cases, it can be due to a lack of information and potential evidence/proof.

- Sometimes, people making the claim are unclear/untruthful about their condition. They should clearly mention or state the information about their condition and how it affects various tasks performed by them on a daily basis.

Not Reapplying:

- When the situation or certain circumstances of an individual changes, they should reapply for the attendance allowance.

- The changes can be related to disability or illness.

- Once rejected, people should check the eligibility requirements and whenever they meet those requirements, they should reapply.

If a person doesn’t need support for at least six months, they won’t be eligible for the attendance allowance. However, special rules can apply if a person has less than 12 months to live.

The application also takes time to complete, as it requires detailed information on various aspects, such as illness or disability. Even after someone submits the complete application successfully, the decision can take time to be made.

|

Important Links |

In addition, people can also be called for an assessment, which can further increase the processing time. In addition, if the necessary supporting documents or proof are not provided, they can lead to the application rejection.

Moreover, if a person is receiving an attendance allowance at a lower rate and their care needs increase, they can also get the allowance at a higher rate.