Check out the details about ACFB Dates: When Alberta Child and Family Benefit is Coming? Who is Eligible? from this article. Different details about ACFB Dates: When Alberta Child and Family Benefit is Coming? Who is Eligible? and other necessary details are included in this article.

ACFB Dates

ACFB, or Alberta Child and Family Benefit, is fully funded by the Alberta government. ACFB not only helps families to provide better support for their children but also allows children to get opportunities to reach their full potential.

The ACFB offers a tax-free amount for households that have children under 18 years old. The payment under the ACFB is issued by the Canada Revenue Agency. ACFB Payments are issued in four months – August, November, February and May.

|

Important Links |

Alberta Child and Family Benefit

| Name | Alberta Child and Family Benefit |

| Administered by | CRA |

| Province | Alberta |

| Funded by | Government of Alberta |

| Payment Type | Tax-Free |

| Payment Period | July 2024 to June 2024 |

| Number of Installments | 4 |

| Payment Dates | February 27, May 26, August 25 and November 27 |

| Website | alberta.ca |

What is Alberta Child and Family Benefit?

Alberta Child and Family Benefit (ACFB) was formed by joining the Alberta Family Employment Tax Credit and Alberta Child Benefit in July 2020. ACFB offers financial aid to families with lower income, provided they meet the necessary eligibility criteria. This financial assistance by the provincial government allows families to make ends meet and get a better quality of life.

On behalf of the Alberta Government, the CRA administers the ACFB Program. The payments are generally made in 4 instalments. The ACFB contains a base component and a working component, with each having a different eligibility criteria and amount.

- Base Component

- This component is for families having eligible children.

- Whether they earn any employable income or not, they can still receive this component.

- Working Component

- This component is for families with a working income exceeding 2,760 dollars.

- The received amount increases at a rate of 15% for each additional dollar earned above 2,760 dollars, till the maximum benefit limit is reached.

- When families work more, they receive greater benefit amounts. This encourages them to join and stay in the workforce.

Who is Eligible for ACFB?

The eligibility for receiving ACFB is –

- applicants should be a parent of one or more children under 18

- applicants must have filed tax return

- applicants should meet income requirements.

- applicants should be Alberta Resident

The Alberta government delivered about 335 million dollars in 2022 – 2024 and plans to deliver about 325 million dollars in 2024 – 2024.

How to Apply for ACFB?

Residents of Alberta will be considered for ACFB if they meet the eligibility requirements of Canada Child Benefit. Therefore, they should only apply for the CCB (if they are eligible).

Aside from applying for the CCB, they do not need to do anything else. In case they have any issues related to the ACFB, they can contact the Canada Revenue Agency.

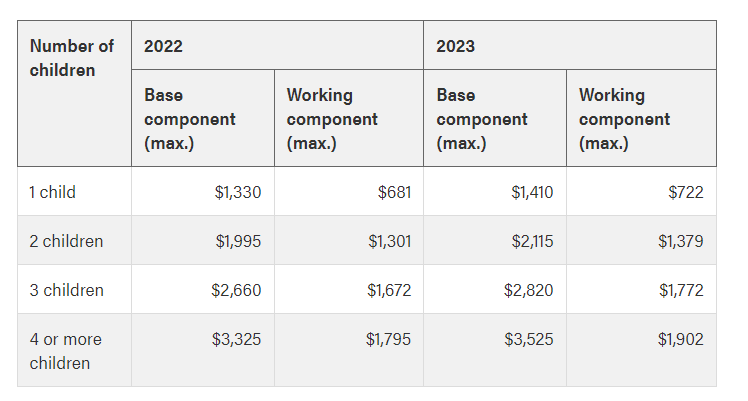

ACFB Amount

The ACFB Amount is calculated based on the income of the family (as per tax return), number of children, and other necessary factors, including residency. The ACFB Amount varies for each component.

Check the Maximum Benefit-

Base component

- For 1 child -> 1,410 dollars

- For 2 children -> 2,115 dollars

- For 3 children -> 2,820 dollars

- For 4 or more children -> 3,525 dollars

The benefit amount reduces as the family income goes above 25,935 dollars. If the AFNI ranges between 25,935 dollars and 43,460 dollars, they may receive partial benefits.

Working component

- For 1 child -> 722 dollars

- For 2 children -> 1,379 dollars

- For 3 children -> 1,772 dollars

- For 4 or more children -> 1,902 dollars

The benefit amount reduces when the family income goes above 43,460 dollars. Additional information regarding the ACFB Benefit Amount can be learned through the Alberta Government’s authorized web portal.

|

Important Links |

When Alberta Child and Family Benefit is Coming?

As mentioned, the ACFB Payments are delivered in four instalments. Check the ACFB payment dates –

| Instalment | Date |

| 1st | February 27 |

| 2nd | May 26 |

| 3rd | August 25 |

| 4th | November 27 |

The payments can either be received through a direct deposit or through a cheque. The beneficiaries can set their preferred payment method through the “CRA My Account”. However, the fastest and most efficient method to receive the ACFB payment is through Direct deposit.

The payments made via direct deposit can take up to 5 business days to be sent to the accounts. In case the beneficiaries don’t get their payments within 5 business days (through direct deposit), they can contact the CRA. Whereas the payments sent via mail (Cheque) usually take more time to be delivered.

| IT Gujarat Home Page | Click Here |