Check out the details about Retirement Age Canada: What is the Retirement Age in Canada (65 or 67)? – All We Know from this article. Various details about Retirement Age Canada: What is the Retirement Age in Canada (65 or 67)? – All We Know and other necessary information are included in this article.

Retirement Age Canada

Many people look forward to their retirement, as it represents that they no longer have to focus on their work responsibilities. Instead, they get to focus on themselves and enjoy their lives. Many people plan their retirement by saving funds and planning other vital things, such as pension plans.

One of the crucial parts of retirement planning is to know the retirement age. It is the age when people retire from their work to spend more time on themselves and their family members. Previously, there was a mandatory retirement age in Canada, i.e., 65 years. However, the law changed, and people in Canada are now allowed to work indefinitely.

|

Important Links |

What is the Retirement Age in Canada

The standard age to retire is 65 years. However, it is not a mandatory age to take retirement. If someone has enough savings, they can always take an early retirement. In case someone plans to receive the benefits of the Canada Pension Plan, they can start receiving it as soon as they get 60 years old. The Canada Pension Plan benefits depend on the age when someone starts the retirement pension and their CPP Contributions.

The longer someone waits to receive the CPP Pension, the higher their CPP payments will be. The CPP allows citizens to take a pension at any time between ages 60 and 70. In the case of the Old Age Security, the minimum age to start the benefits is 65 years. More information on the age requirements for various types of retirement benefits in Canada can be learned by checking the official website of the Canadian Government.

Retirement Age in Canada 65 or 67

According to Statistics Canada, the average retirement age for females in 2022 was 63.6 years. Whereas the median retirement age of females in 2022 was 63.8 years. In the case of males, the average retirement age in 2022 was 65.5 years, whereas the median retirement age of males in 2022 was 65.2 years.

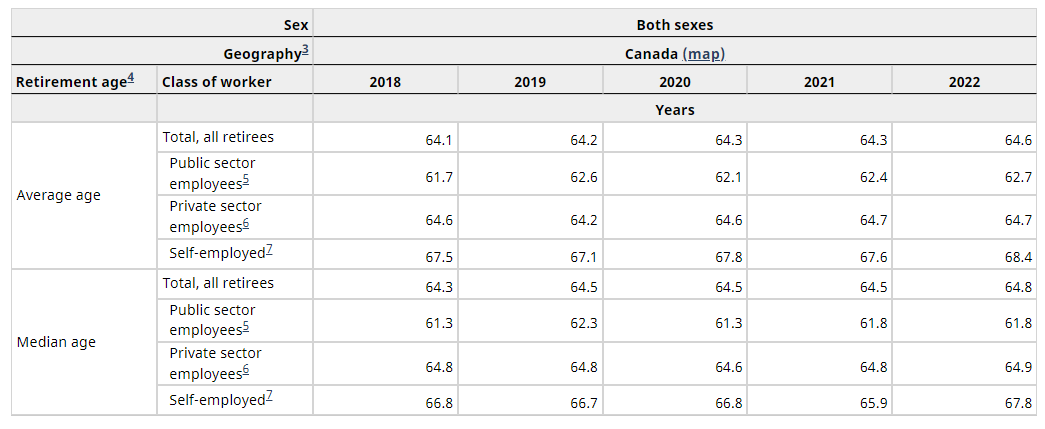

In the case of both males and females, the average retirement age in 2022 was 64.6 years, whereas the median retirement age in 2022 was 64.8 years. In 2021, the average and median retirement ages of both males and females were 64.3 years and 64.5 years, respectively.

Check the average retirement age of both males and females in Canada-

| Worker’s Class | 2020 | 2021 | 2022 |

| Total, all retirees | 64.3 years | 64.3 years | 64.6 years |

| Public sector | 62.1 years | 62.4 years | 62.7 years |

| Private sector | 64.6 years | 64.7 years | 64.7 years |

| Self-employed | 67.8 years | 67.6 years | 68.4 years |

Check the median retirement age of both males and females in Canada-

| Worker’s Class | 2020 | 2021 | 2022 |

| Total, all retirees | 64.5 years | 64.5 years | 64.8 years |

| Public sector | 61.3 years | 61.8 years | 61.8 years |

| Private sector | 64.6 years | 64.8 years | 64.9 years |

| Self-employed | 66.8 years | 65.9 years | 67.8 years |

More information on the average and median retirement ages in Canada can be learned through the website of Statistics Canada. The average and median retirement ages are calculated using the retirement ages of the public sector employees, private-sector employees, and self-employed. The average and median retirement ages can change every year, depending on various factors.

All We Know About Retirement Age Canada

The earlier retirement age can be determined using several factors, including government pension benefits, retirement savings, type of retirement, company pension plans, etc. People should consider all these aspects to determine their retirement ages. As mentioned, in case they are looking to receive government benefits after retirement, they should also check whether they are eligible or not.

Some benefit plans have additional requirements aside from age criteria. How people are looking to spend their retirement can also be a relevant factor in determining the retirement age. If someone is looking to make some purchase or looking to travel, they should check for their saved funds and other benefits they might receive.

|

Important Links |

Moreover, citizens can also use the Retirement Income Calculator available on the authorized website of the Canadian Government to calculate how much they can receive from federal benefits, such as CPP and OAS. To use this calculator, the citizens have to enter several necessary information, including their financial information, RRSP statements, contributions, etc.

People can opt for early retirement, i.e., below age 60, in case they have an excellent company pension, high salaries, a large inheritance, and a good retirement plan. The average retirements are usually between the ages of 60 and 70. Some people also take late retirements, i.e., 70+.