Check out the details about Weekly Tax Table Australia 2024 PDF, ATO Tax Rates & Codes from this article. Many details regarding the Weekly Tax Table Australia 2024 PDF, ATO Tax Rates & Codes, and other important details are included in this article.

Weekly Tax Table Australia 2024

Many employers in Australia pay salaries to their workers on a weekly basis. The Australia weekly tax table is used to determine the withholding amount from the payments of their employees or other workers.

The Weekly Tax Table Australia shows the amount to be withheld by employers based on employee salaries. In addition to the weekly tax table, the ATO also provides different kinds of tax tables for different needs, such as monthly tax tables, Fortnightly tax tables, Tax tables for daily and casual workers, etc.

|

Important Links |

Weekly Tax Table Australia PDF 2024

The Weekly Tax Table Australia is also available in a PDF version. This PDF version of the Weekly Tax Table Australia can be downloaded by visiting the authorized website of the Australian Taxation Office (ATO).

In addition to the PDF version, the ATO also provides the Withholding lookup tool, which allows employers to search and find the correct withholding amounts easily. Furthermore, the Weekly Tax Table Australia is quite easy to use, and ATO provides all the instructions and guidelines to use this significant table.

How to use Weekly Tax Table Australia 2024

The Weekly Tax Table can be used if the following payments are being made on a weekly basis –

- wages/salaries

- directors’ fees

- government education or training payments

- payments to labour-hire workers

- salary and allowances to office holders

- compensation, sickness, or accident payments

- paid parental leave

- payments to religious practitioners

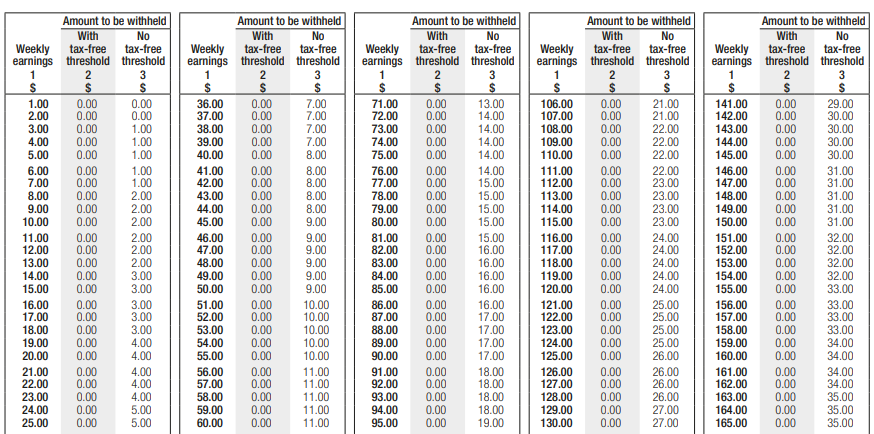

The Weekly Tax Table Australia has three columns – weekly earnings, with a tax-free threshold, and no tax-free threshold. Employers can use these columns and determine how much they can withhold from the payments on the basis of weekly earnings.

To use the Weekly Tax Table Australia, check these steps-

- Calculate the total weekly salary of the employee. (To do this, add allowances (if any) and irregular payments of a particular week to the basic weekly earnings.)

- Find the calculated amount in the table.

- Select the respective column associated with that amount to know how much they can withhold.

For example:- The calculated weekly earnings of a worker is 563.60 dollars. So, if the worker is claiming the tax-free threshold, use the weekly tax table and find the correct amount to withhold, i.e., 50 dollars. However, if the worker is not claiming the tax-free threshold, the amount to withhold will be 132 dollars (according to the table).

For example:- The calculated weekly earnings of a worker is 1,196 dollars. If claiming the tax-free threshold, the withholding amount will be 230 dollars. If not claiming the tax‑free threshold, the withholding amount will be 351 dollars.

|

Important Links |

ATO Tax Rates & Codes 2024

The tax rates in Australia are set by the Australian Taxation Office (ATO). The ATO Tax Rates can change each year. To learn about the ATO Tax Rates, individuals can go to ATO’s authorized website and check the current year’s tax rates. Similar to some other countries, the tax rates in Australia are based on the taxable income of the citizens.

| Bracket | Tax |

| 0 to 18,200 dollars | No Tax |

| 18,201 dollars to 45,000 dollars | 19c for each 1 dollar over 18,200 dollars |

| 45,001 dollars to 120,000 dollars | 5,092 dollars plus 32.5c for each 1 dollar over 45,000 dollars |

| 120,001 dollars to 180,000 dollars | 29,467 dollars plus 37c for each 1 dollar over 120,000 dollars |

| 180,001 dollars and more | 51,667 dollars plus 45c for each 1 dollar over 180,000 dollars |

Furthermore, the taxable income in Australia is divided into 5 tax brackets, with each having different applicable taxes. For citizens having taxable incomes less than 18,200 dollars, there will be no tax. In case the taxable income exceeds 180,001, they have to pay 51,667 dollars plus 45c for each 1 dollar over 180,000 dollars.

In addition, these tax rates do not include a Medicare levy of 2%. The ATO provides a simple tax calculator, which can be used to gross tax on individuals’ taxable income. This significant calculator uses the information on – the tax year, residency, taxable income, etc., to determine the owed taxes.

Some of the ATO Tax codes may include – GST, FRE, EXP, CAP, INP, ITS, LCT, LCG, VWH, GW, WET, N-T, ABN, etc. The codes can be used in a variety of situations. More information on the tax codes can be obtained from the website of the ATO.

| IT Gujarat Home Page | Click Here |