Check out the details about ODSP Payment Dates 2024 – ODSP Hidden Benefits, Login, and How to Apply from this article. Numerous details regarding ODSP Payment Dates 2024 – ODSP Hidden Benefits, Login, How to Apply, and other necessary information are available in this article.

ODSP Payment Dates 2024

The ODSP provides employment and financial support to people with disabilities. This social assistance scheme is an initiative of Ontario province. ODSP offers employment support, money to help individuals and their eligible family members, and health benefits.

Each month, the eligible applicants receive payments depending on their living situation. The next ODSP Payment Date is October 31 and November 30. Applicants can learn about the ODSP Payment Dates 2024 through the authorized website of the Government of Ontario.

|

Important Links |

ODSP Payment 2024

| Name | Ontario Disability Support Program |

| Province | Ontario |

| Administering Body | Government of Ontario |

| Country | Canada |

| Beneficiaries | People with disabilities |

| Benefits | employment support, monthly payments, and health benefits |

| Age | 18 or older |

| Maximum Payment | 1,308 dollars (Single) |

| Website | ontario.ca |

What is ODSP 2024

ODSP provides a number of benefits for persons with disabilities living in Ontario province. In addition, the individual’s impairment, expected duration, and restrictions must be verified by an approved healthcare professional.

Hence, before applying for the ODSP, applicants should go through the eligibility criteria –

- Must be at least 18 years old.

- Must be living in Ontario.

- Individual assets must not exceed the limits set by the Government.

- Should be in need of financial assistance.

- Must be a person with a disability.

ODSP Amount 2024

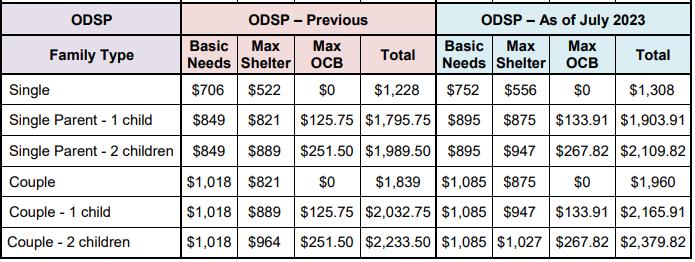

The amount that an applicant can receive through ODSP Payments was recently increased by 6.5%. Previously, the individuals (single) were receiving 1,228 dollars per month. Now, that payment has been increased to 1,308 dollars.

The amount of ODSP includes 752 dollars for basic needs and 556 dollars for max shelter. In addition, the ODSP amounts for the single parent (1 child), couple, single Parent (2 children), Couple (1 Child), and Couple (2 Children) have also been increased.

ODSP Hidden Benefits 2024

ODSP payments are based on the living situation and other relevant factors. In case the applicant owns or rents a home, their monthly payment will include the following –

- Basic Needs

- It covers clothing, food, and other essential personal things.

- The amount is based on the number of people in the family, the age of family members, and whether or not the individual’s spouse has a disability.

- Shelter Allowance

- It covers the rent or mortgage payment, utilities, property taxes, condominium fees, heat, and home insurance.

- The amount is based on actual shelter costs based on the number of individuals in the family.

If the individuals obtain food as well as shelter from the same source, they will receive Board and Lodging payments.

- Board and lodging

- Individuals are in this situation if, – they live with their parents, who also buy and make food for them, OR their landlord buys and makes food for them.

- The payment is based on the number of people in the family and their ages.

If the individuals live in Northern Ontario, they will receive –

- Remote Communities Allowance

- Individuals can receive this allowance whether they own a home, live in rent, or live in a board and lodging arrangement.

ODSP Login 2024

Applicants registered with the ODSP program can login to My Benefits by using their My Ontario Account. They must login using their email/password to access the ODSP.

|

Important Links |

The login will allow the applicants to complete their pending applications, report any changes, or access information about their ODSP benefits. The login on My Benefits is available for applicants, members, and trustees.

How to Apply for ODSP 2024

Applicants can apply for the ODSP through the authorized website of the Government of Ontario. The online application process for the ODSP takes about 20 to 30 minutes. Applicants will need their SIN, OHIP cards, tax returns, immigration papers, banking information, birth certificates, etc.

First, applicants have to submit their details on the application portal of the ODSP. After that, ODSP will review the application and call the individuals within 15 days to schedule an appointment.

After applying for the ODSP, the officials will provide a Disability Determination Package, which has to be submitted within 90 days. The Disability Determination Package is required to be completed by the applicant and approved healthcare professionals.

If the applicants fail to return the package within 90 days, the ODSP application will be considered “withdrawn.” However, applicants can send a written request for an extension of the package submission period. After the submission of the Disability Determination Package, the officials will review it and notify the applicant whether they are qualified or not.

| IT Gujarat Home Page | Click Here |

Why do single people get less disability monthly payment then couples? Both can live in 1 bedroom, not much difference in food cost or other necessary bills!

Single $1,308 per month

Couples $1,960 per month

Difference of $652 per month

Why such big difference?

The Canadian/ Ontario government leave singles people behind on the help with inflation ( and if on ODSPjust get worse) . Families seem to get extra money on child tax a lot, singles get nothing but when the government dose finally help singles its with GST single payment and families get that too. For singles that 1 time payment of maybe around $200 doesn’t cover more then 1 week or 2 if stretching it out out of 52 weeks in a year.