In this article, you will get to know about the SSS Contribution Table 2024: How to check Contribution? How to Pay? All We Know. For the year 2024, the Social Security System have set out the new contribution rates for both employer and employees in the Philippines. These contributions operate with collective responsibility, and the member of the contribution has to make a portion of their income to the federal system to receive the financial benefits in return. These contributions are outlined with the monthly contribution that is based on the SSS members. To know more about the SSS Contribution Table 2024, how to contribute, and more, continue browsing this article.

SSS Contribution Table 2024

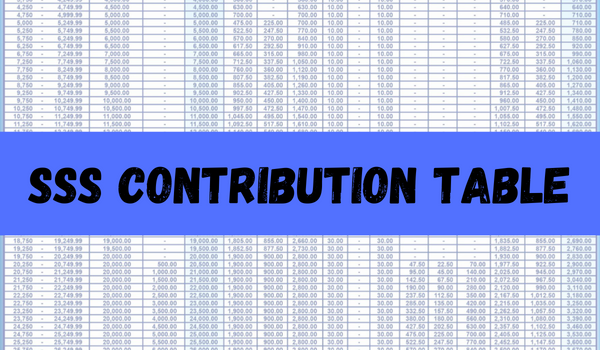

In 2024, the Social Security System contribution rate has been set at 14%, of which 9.5% is for employers and 4.5% is for employees. In this their monthly salary is required to range between R4,000 to P30,000. The SSS contribution table is a document that outlines the contributions which are required to be paid in the SSS Philippines.

The SSS Contribution Table is based on the recipient’s salary and the member of SSS. The contributor is required to make monthly contributions to SSS to receive the benefits and services through the federal organization. The contribution includes retirement, disability, pensions, and loans or other forms of financial assistance, which are completely based on employer and employee contributions.

|

Important Links |

How to check Contribution?

The SSS contributions are checked with the lists of minimum and maximum monthly salary and the corresponding monthly salary bracket. The check the SSS Contribution, the contributors are required to follow the below-mentioned steps.

Step 1: Browse the leading portal of the Social Security System and access your account.

Step 2: After accessing your account, you will see the four buttons on the upper right panel of the homepage, where you select the contribution, and you will be redirected to the new webpage.

Step 3: Here, you are required to fill out the required details and then click on the SSS contribution inquiry page, which contains the details of your monthly contribution, SE/VM contribution for voluntary members or self-employed, WISP Plus, Flexi Fund and WISP.

With the help of the www.sss.gov.ph portal, you will be able to check your SSS Contribution Table by just entering your User ID and Password. Along with this, you can also check your contribution by texting the SSS Contribution with your valid SSS number and PIN to 2600.

How to Pay SSS Contribution?

To pay your SSS Contribution, first, you need to come under the federal SSS Contribution Table who come under the table criteria then they are required to follow the mentioned steps:

- Log in to your Social Security System account.

- Receive a PRN

- Log in with GCash or any BIP mobile application.

- Go for the pay bill and select Government >> SSS Contribution.

- After that, fill out the application form and provide the required details and click on the next to receive the details.

By following these mentioned steps you can pay your SSS contribution. Along with this, you can also pay your SSS contribution at the SSS telling or partner bank, which includes Asia United Bank, Bank One Savings Bank, Philippine Business Bank, Bank of Commerce, and First Isabela Cooperative Bank.

|

Important Links |

All We Know

The SSS Contribution Table release an annual payment, which is scheduled with monthly contributions from its member that involves employees and employers. These contributions are made with short wages and a limited budget that are looking out the additional expenses and employment status. The contribution table is made up of a range of compensation, monthly salary credits, the total amount of contribution and the type of membership.

Both the employer and employee are required to qualify for acquiring the SSS benefits that include salary loans, death benefits, disability benefits, retirement benefits, unemployment separation benefits, sickness benefits and more. The individual members can also make their SSS Contribution Table to verify their contribution. The table is aligned with the recipient’s income, which is determined based on benefits and loans available through the Social Security System.

To read other articles, Click Here