Check out the details about Carers Allowance 2024 How Much is Carers Allowance? Eligibility, Rate from this article. Various details about Carers Allowance 2024 How Much is Carers Allowance? Eligibility, Rate and other noteworthy information are included in this article.

Carers Allowance 2024

The UK Government provides Carers Allowance to the people who care for someone having an illness or disability and receives certain benefits. In addition to this, they must take care of them for at least 35 hours a week to qualify for the carers allowance.

Individuals who claim the Carer’s Allowance are not required to be a relative of the person that they are providing care for or live with them. People who get Carers Allowance have to pay tax on the payment if their income exceeds personal allowance.

|

Important Links |

Carers Allowance Eligibility 2024

Both the person providing care and the person receiving care should meet the requirements set by the government in order to receive the Carers Allowance. Please note that if more than one person is providing care for the same person, only one of them can get the Carer’s Allowance.

Eligibility requirement for the “Carer” –

- Over 16 years.

- Must provide care for at least 35 hours per week.

- Earnings should be less than or equal to £139 per week after tax, expenses, and National Insurance.

- Shouldn’t be in full-time education.

- Shouldn’t be subject to immigration control.

Earnings refer to the income that comes from employment/self-employment after Tax/National Insurance/Expenses. Payments that are not counted as earnings are –

- Loan/Advanced Payment from employer.

- Money from an occupational/private pension.

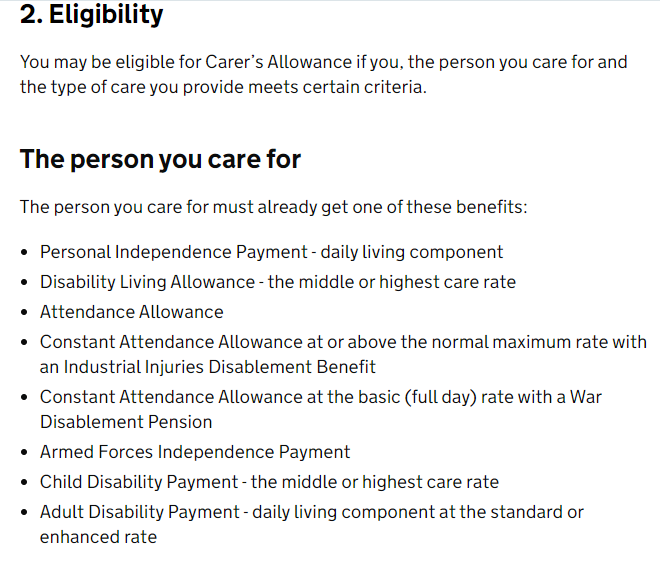

Eligibility requirement for the person receiving care –

They should be receiving any of these –

- Armed Forces Independence Payment

- Attendance Allowance

- Personal Independence Payment

- Child Disability Payment

- Adult Disability Payment

- Disability Living Allowance

- Constant Attendance Allowance

Please note that these mentioned benefits can also have some additional requirements. For example, people are required to receive the middle/highest care rate from Child Disability Payment.

Therefore, people should check the complete list of eligibility requirements for the Carer’s Allowance by visiting the UK Government’s website.

If someone cares for a person with others, people can’t get a Carer’s allowance if the other person –

- is claiming Carers Allowance

- getting an extra amount of Universal Credit for caring for someone receiving a disability benefit

Care Eligibility –

Care can include –

- taking them to a doctor’s appointment

- helping with cooking/washing

- helping with household tasks, i.e., shopping, managing bills, etc.

Carers Allowance Rate 2024

If the carer is receiving a state pension as well as a carer’s allowance, they cannot receive the full amounts from both benefits at the same time.

- If the pension exceeds £76.75 per week, they won’t get Carer’s Allowance.

- If the pension is less than £76.75 per week, they will receive the Carer’s Allowance to make up the difference.

If the state pension exceeds £76.75 per week, they won’t get Carers Allowance, but their pension credit payments will increase.

Please note that receiving a Carer’s Allowance can affect other benefits that a carer and the person receiving care can get.

When the Carer gets this allowance, the person they are caring for stops receiving –

- severe disability premium (sent with other benefits)

- an extra amount of severe disability premium (sent with pension credit)

When the Carer gets the allowance, their other benefits might change. However, their total payments from benefits will either stay the same or get higher.

How to Claim Carers Allowance?

People can apply for the Carer’s Allowance through the online method or by post. If someone wishes to apply through the post, they need to get a form from the authorities. They can request the form by calling them.

To apply, people should make sure that they have all the necessary information or documents with them. These include –

- National Insurance number

- employment details

- bank details

- latest payslip if working

- course details if studying

- expense details

Moreover, they should also provide the details about the person that they are caring for –

- address

- D.O.B.

- National Insurance Number

- Disability Living Allowance reference

|

Important Links |

How Much is Carers Allowance?

A person care receives £76.75 per week, provided they satisfy all the eligibility requirements. Please note that if someone provides care for more than 1 person, they cannot claim this allowance for both of them.

In case the person that the Carer was caring for dies, they will continue to receive the allowance for up to 8 weeks. If the carer is in hospital for a minimum of 8 weeks, they will receive the allowance for up to 12 weeks.

Therefore, people receiving the Carers Allowance should immediately report any change in their circumstances/situation to the authorities.