Check out the details about CRA Medical Expenses: What Medical Expenses are tax Deductible and How Much Can You Claim? from this article. Numerous details about CRA Medical Expenses: What Medical Expenses are tax Deductible, and How Much Can You Claim? and other relevant details are included in this article.

CRA Medical Expenses

Individuals who have incurred large medical expenses either for themselves or for their dependents can claim medical expense tax credit. This credit is a type of non-refundable tax credit that can be applied to reduce the Part I tax liability.

This CRA medical Expense tax credit provides relief to individuals for their expenses, such as dental care, medical supplies, and travel expenses. Individuals can only claim part of an expense for which they haven’t or won’t be reimbursed.

|

Important Links |

What Medical Expenses are Tax Deductible?

CRA provides a common list of eligible medical expenses along with relevant information, such as type, additional requirements, eligible or not, etc. Please note that the medical expenses can only be claimed if either the individual or their spouse or common-law partner has paid for the medical expenses.

Some of the eligible medical expenses include –

- Acoustic coupler: You need a prescription for this expense.

- Artificial eye or limb: No need to fill out Form T2201 or have a prescription.

- Audible signal devices: Requires a prescription.

- Dental services: No need to fill out Form T2201 or have a prescription.

- Driveway access: To ease access to a bus, the amounts paid to alter the driveway (residence)

- Electrotherapy devices: Requires a prescription.

- Electronic bone healing devices: Requires a prescription.

- Infusion pump: Requires a prescription.

- Heart monitoring devices: Requires a prescription.

- Liver extract injections: For individuals having pernicious anaemia.

- Needles and syringes: Requires a prescription.

- Orthopaedic shoes, boots, and inserts: You need a prescription for this expense.

- Oxygen and oxygen tent: It can also include other equipment to administer oxygen.

- Rehabilitative therapy: It also includes lip reading & sign language training to adjust a person’s hearing or speech loss.

- Standing devices: For standing therapy.

- Pressure pulse therapy devices: For treating balance disorder.

- Voice recognition software: Requires Certification in writing by a medical practitioner.

- Service animals: No prescription is required for this expense.

- Wheelchairs and wheelchair carriers: No prescription or certification in writing is required to claim it.

- Treatment centre: A certification in writing is necessary to claim this expense.

Other than these medical expenses, there are many other expenses that a person can claim. Moreover, the information, eligibility and requirement for each type of medical expense is provided on the authorized web portal of the Government of Canada.

Documents Needed to Support CRA Medical Expenses Claim

People shouldn’t send any documents with their tax returns as proof of their eligible medical expenses. However, they should safely keep these documents in case CRA asks for further verification. These documents will allow the CRA to make the decision on whether they agree with the claim or not.

The following documents can be asked by CRA (depending on the type of medical expense claim a person has filed) –

- Certification in writing: This document is provided by a medical practitioner. Some types of medical expenses require this document.

- Prescription: Prescription is usually provided by a medical practitioner.

- Receipts: It should indicate the name of the person to whom the fee was paid.

- Form T2201: Some medical expenses may require this Form (approved by CRA).

Possessing these documents will ensure faster processing (if CRA asks to see them).

How Much Medical Expenses Can You Claim?

The medical expenses can be claimed on Tax Return’s line 33199 or line 33099.

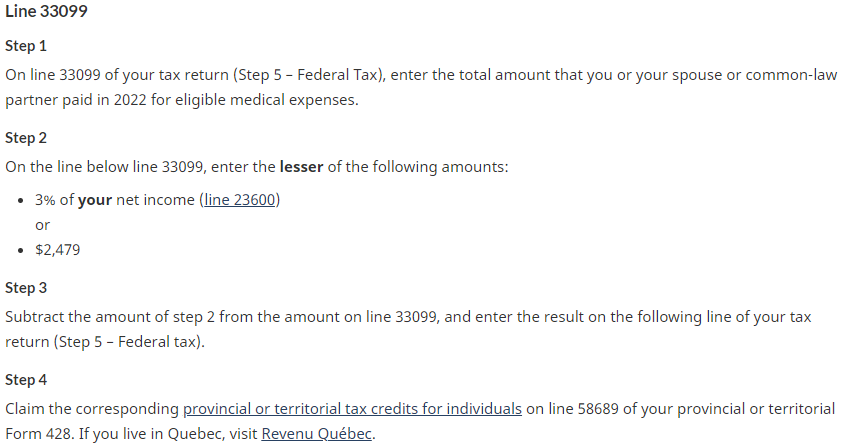

Line 33099:

- It can be used to claim the eligible medical expenses for an individual, their spouse, and their dependant children under 18.

Line 33199:

- It can be used to claim the part of the expense that an individual or their spouse paid for the people who depended on them for support –

- their children over 18 years of age.

- their parents/brothers/sisters/aunts/nieces/grand-parents/uncles/nephews.

|

Important Links |

For line 33099, first, enter the full amount of medical expenses. On the next line, enter the lesser of – 3% of net income or 2,479 dollars. Now, subtract the total amount of medical expenses from the amount on the next line.

For line 33199, enter the full amount of medical expenses. On the next line, find which amount is less – 3% of the dependent’s income or 2,479 dollars. Now, subtract the less amount from the total amount of medical expenses.