Check out the details about Ontario Trillium Benefit Dates – What is OTB, Eligibility, Payment from this article. Various details about Ontario Trillium Benefit Dates – What is OTB, Eligibility, Payment, and other necessary details are included in this article.

Ontario Trillium Benefit

The Ontario Trillium Benefits is a tax credit applicable in the Ontario province. The Ontario Trillium Benefit comprises three main components (credits), with each having different eligibility criteria. The annual OTB payment is generally divided by 12 (total months) and sent as monthly payments to the eligible residents.

|

Important Links |

The OTB Payments are generally issued on the 10th of every month. If the 10th falls on any holiday or non-working day, the payments will be given on the final business day before the 10th. The next payment of the OTB is scheduled on October 10, 2024.

Ontario Trillium Benefit Dates

| Name | Ontario Trillium Benefit |

| Province | Ontario |

| Country | Canada |

| Type | Credit |

| Frequency | Monthly |

| Benefit year | 2024 (July 2024 – June 2024) |

| Base Year | 2022 |

| Combination of | NOEC, OEPTC, OSTC |

| Payment Dates | October 10, November 10, 2024, December 8, 2024 |

| Website | ontario.ca |

| Benefit Dates | Check here |

What is OTB (Ontario Trillium Benefit)?

The Ontario Trillium Benefit (OTB) is a combination of three credits – the Northern Ontario Energy Credit, the Ontario Sales Tax Credit, and the Ontario Energy and Property Tax Credit. The OTB is a credit designed to assist the residents of Ontario in paying for their energy costs and sales and property tax. Many residents of this province receive these monthly payments from the government.

To receive the benefits of the OTB, the citizens of Ontario province must be eligible for at least one of the mentioned credits. This means that even if the resident qualifies for just one credit, they will still be eligible for the OTB. The payments received by the eligible beneficiaries are based on their 2022 income tax and benefit returns. In addition, these payments are sent in monthly installments.

OTB Payment Dates

If the individuals have opted to wait to get a lump-sum payment of the Ontario Trillium Benefit for 2024 and the annual amount exceeds 360 dollars, the payment will be given as one payment on June 10, 2024. However, if the annual amount is less than 360 dollars, the payment will be issued in the first payment month.

Individuals can choose to receive their OTB Entitlement as one payment when they initially file their taxes. However, if they haven’t filed their 2022 return and wish to receive the OTB in one payment, they must opt for it before December 31, 2024. The Ontario Trillium Benefit Payment dates can be checked through the authorized website of the Government of Canada.

Ontario Trillium Benefit Eligibility

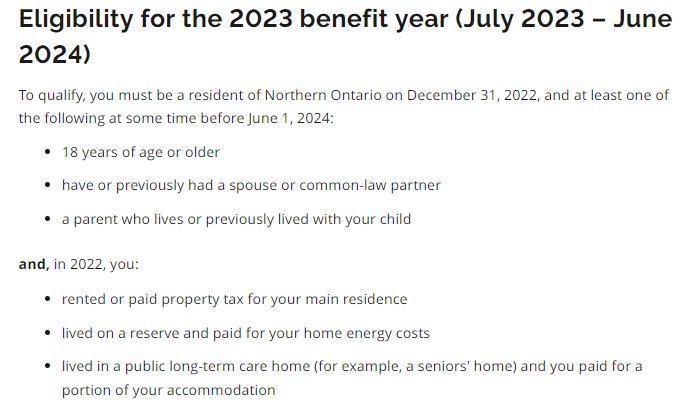

In the case of NOEC, they must be a resident of Northern Ontario (Algoma/Kenora/Nipissing/Rainy River/Thunder Bay/Timiskaming/Sudbury/Parry Sound/Manitoulin/Cochrane).

Ontario Trillium Benefit Eligibility for NOEC

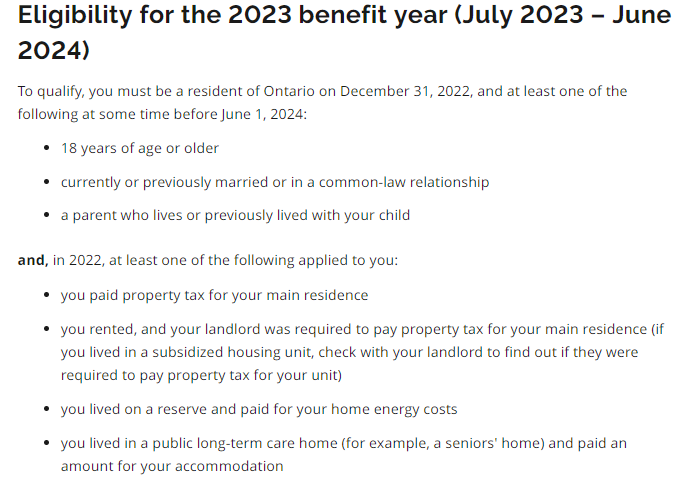

Ontario Trillium Benefit Eligibility for OEPTC

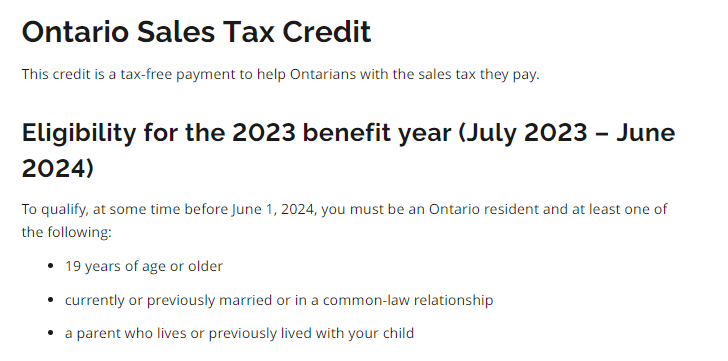

Ontario Trillium Benefit Eligibility for OSTC

Additionally, they must fulfill the respective eligibility criteria of the NOEC, OEPTC, and OSTC. The complete list of eligibility conditions can be learned either from the authorized website of the Ontario Government or the Government of Canada’s website.

|

Important Links |

To apply for the OTB, the applicants must file their last year’s tax returns. The Canada Revenue Agency will decide whether or not the individuals are eligible for the OTB.

Ontario Trillium Benefit Payment

The credit for each Ontario Trillium Benefit component differs from one another. The benefits are usually based on – Age, residence, income, the size of the family, amount paid in rent or property tax. Individuals can calculate how much they can receive as their Ontario Trillium Benefit Payment by using the calculator available on the Government of Canada’s website.

- NOEC

- For single individuals, the maximum amount is 172 dollars.

- For families, the maximum amount is 265 dollars.

- OSTC

- Can receive up to 345 dollars.

- Additional credit up to 345 dollars can be received for –

- Spouse/Common-law partner

- each dependent child aged under 19 years on the first payment month.

- The GST/HST credit payments are not affected by the OSTC.

- OEPTC

- If aged between 18 and 64 years, individuals can receive up to 1,194 dollars.

- If aged 65 or older, individuals can receive up to 1,360 dollars

- If individuals live on a reserve or in a public long-term care home, they can receive up to 265 dollars.

More detailed payment information on the Ontario Trillium Benefit Payment is provided by the government of Canada on its authorized website.

| IT Gujarat Home Page | Click Here |