Check out the details about Backpay in USA: 20.6% Raise of SSA, SSI, SSDI and VA in 2024: Complete News from this article. Different information about Backpay in USA: 20.6% Raise of SSA, SSI, SSDI and VA in 2024: Complete News and other notable things are included in this article.

Backpay in USA

The cost of living adjustment is set at 3.2% for 2024. However, it is far less than what was increased for 2023, i.e., 8.7%. Therefore, many people are wondering why it is less than the previous adjustment in the cost of living.

They are wondering about this because if the percentage of increase is more than 3.2%, they will get a greater increase in their benefits. However, the 3.2% increase was the result of a thorough calculation based on the changes in the CPI-W.

|

Important Links |

20.6% Raise of SSA, SSI, SSDI and VA in 2024

Despite the increase, some people are hoping that SSA will announce backpay in the USA, which will increase their benefit rates of SSA, SSI, SSDI, and VA in 2024. A video even suggested a 20.6% raise for various Social Security benefits.

The calculation of this backpay raise of 20.6% is based on a “hypothetical scenario”. This is because the 20.6% will be the result if the increase in 2023 COLA was 17.4% instead of 8.7% and the current 3.2% is added to it.

As we know, the COLA is based on inflation and is provided every October. However, some people believe that the inflation was much higher in 2022 than the government said. According to them, the inflation was almost double the figures mentioned by the authorities.

Some believe that the government is thinking of providing backpay by raising the benefit rate from 3.2% to 20.6% to compensate for the previous lower adjustments (according to them).

Therefore, they believe the COLA should also be doubled and added to the current 3.2% for 2024 to make it 20.6%. However, the government has neither announced any plans for this increase nor is it likely to increase COLA by a greater percentage.

This is just a hypothetical scenario that includes the addition of the 2023 COLA’s double and the 2024 COLA. Therefore, people should not get their hopes raised because it doesn’t work like this.

Even if there are any plans to increase the COLA for 2024, only the SSA and the government can provide the correct facts about it. Furthermore, a 20.6% increase is quite substantial, and it is not possible for the government to increase the benefits of each individual by this huge percentage at once without any preplanning.

This is why people should only trust official government sources regarding the information about the increase in 2024 COLA and Social Security benefits.

Complete News about Backpay in the USA

There is no information regarding the backpay that raises the Social Security benefits in the USA from any official government sources. In fact, it is just a hypothetical situation presented in an online video.

Any official statement and information regarding the COLA and changes in the Social Security amounts are usually provided by the Social Security Administration on its website.

It is very less likely that the government will further increase the Social Security Benefits by raising the COLA for 2024. They have already raised the benefits based on a 3.2% COLA, which was calculated using the data of CPI-W provided by the Bureau of Labor Statistics.

How the computation of the COLA for 2024 was done, including which data sets were used and what steps were taken by the authorities, can also be found on the SSA’s authorized web portal.

Therefore, we have found that a 20.6% backpay raise is not going to happen, as no official government sources have stated so. Always use the official government websites to find out about various government-administered programs and their respective changes.

How was COLA for 2024 Computed?

As we know, COLA is calculated on the basis of the CPI of Urban Wage Earners and Clerical Workers. The data of CPI-W is published each month by the Bureau of Labor Statistics.

|

Important Links |

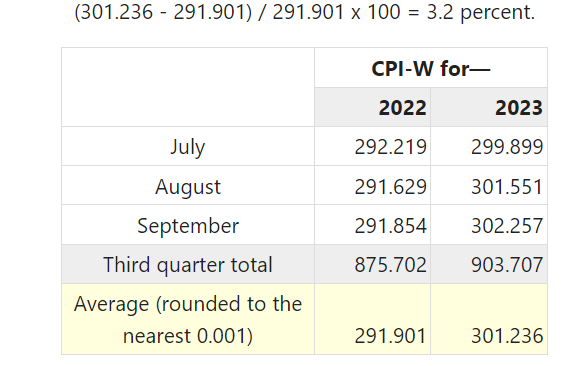

The authorities used the data of the CPI-W of the third quarter of 2022 and 2023. The third quarter comprises July, August and September.

The average for 2022’s 3rd quarter was 291.901, and the average for 2023’s 3rd quarter was 301.236. Since the average of 2023’s 3rd quarter exceeded the average of 2022’s 3rd quarter by 3.2%, the COLA for 2024 was determined to be 3.2%.