Get to know the vital information on the Age Pension Rates Australia: Assets Test, Eligibility, Calculator, Amount, and Payment Dates here. Citizens eligible for the pension also receive the Pensioner Concession Card and Commonwealth Seniors Health Card to receive the benefits on the lifestyle requirements. Retirees must check the Age Pension Rates Australia before applying for the pension. This will help them understand the total amount they will be getting after retirement.

Age Pension Rates Australia

The Age Pension application must be submitted within 13 weeks of the retirement to receive the considerable amount. This is because the verification process consumes time, and we are sure that you are not expecting a delay in the pension.

For the retirees of 2023, the Age Pension Rates Australia will be revised, whilst for the present-year retired citizens, the increase in the amount will be reflected after March 2024.

|

Important Links |

What is the Meant by Assets Test in Australia?

The Department of Social Services has made a regulation in which the assets of the retiree will be checked. This is to analyze the overall requirement of the expenses by a particular citizen. The fortnightly payments are made only when the authorities confirm your eligibility.

The citizens have to submit the relevant documents that include employment details, total salary (after increment), salary slips (to determine the last drawn salary), family details, property assets (if any), and more.

| Particulars | Amount |

| Single Homeowners | $301,750 |

| Couple Homeowners | $451,500 |

| Non-Homeowners | Up to $693,500 |

The table above represents the data for the assets that the particular individual needs to have.

Age Pension Australia Eligibility

The two most important aspects the officials will confirm are your age and the income assets. If the income is higher than required, the applicant will not be eligible for a pension.

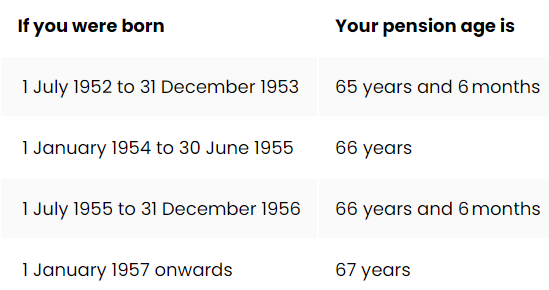

- The Australian Pension Age February is 65 years or older. The citizens must retire at this age to begin receiving pensionable benefits.

- The immigrants must share the residency proof that they have stayed in the nation for about 10 years.

- The important part is the taxes. All the citizens have to pay the taxable amount every financial year. The Taxation Department checks the financial statements from the tax returns that the individuals fill. This can be done via two methods: online or offline. In both scenarios, the taxpayer can get assistance from an account.

We have also provided the image representation, including the age criteria for the potential beneficiaries.

In the next section, we will share the details of how retired Aussies can calculate their pension.

Age Pension Rates Calculator

The Australian Taxation Office generally provides the rates concerned with checking out people’s financial statements. The Department also supports the country’s economy and tax records. The citizens who are not paying the taxes will be exempted from the pension. Thus, the working individuals who have stopped working must adhere to the Government rules.

|

Important Links |

Various unofficial calculators are available for your reference, but we suggest you acknowledge the data from the official portal. Enter marital status, whether you are a tenant or a landowner, assessable assets, and your fortnight income.

| Latest updated | Single Person | Couples (each) |

| Max Basic Rate | 1,002.50 AUD | 732.30 AUD |

| Max supplement | 80.10 AUD | 59.10 AUD |

| Energy Supplement | 14.10 AUD | 10.6 AUD |

| Total | 1,096.7 AUD | 802 AUD |

The table above represents the Changes in the Aged Pension Rate. The pensioners can also navigate to the main website of Services Australia to acknowledge the latest news, as we have shared the general information here.

Age Pension Payment Dates 2024

Now, we will be sharing the amount that the pensioner will receive from the Government. The single individual will get up to $1096.70, and couples will receive $1653.40 within the duration of around 2 weeks. The Australian Bureau of Statistics will check on the consumer price index, inflation, average salary of Australians and more phenomena to increase the amount.

If we decide on the salary part, then $37.99 per hour is the basic amount that is provided to the workers. However, the wage can be increased according to the employment type, position, skills, etc. The employer mainly decides this, but the lowest wages are fixed.

Usually, the pension is transferred on the last day of the month. The possible dates are 13th or 14th February 2024. There might be a change in the schedule for around 2-3 business days.